pay estimated indiana state taxes

The average income tax rate for counties and large municipalities is 116 according to the Tax Foundation weighted by income. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220

Residents of Indiana are taxed at a flat state income rate of 323.

. The tax bill is a penalty for not making proper estimated tax payments. Indiana state income tax withholding calculator also takes into account any tax that a county may imposeThis is because the state of Indiana has a flat tax rate at 323 rate. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

Line I This is your estimated tax installment payment. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax. Select the Make a Payment link under the.

Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

If you delete a message on imessage does it delete for the other person. Lines J K and L If you are paying only the. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. Lines J K and L If you are paying only the. The state tax Indiana collected 164 billion in income taxes during fiscal year 2018 which was a 54 increase over fiscal year 2017.

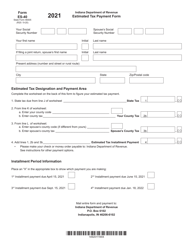

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Line I This is your estimated tax installment payment. Line I This is your estimated tax installment payment.

The Indiana personal exemption includes a 1500. Lines J K and L If you are paying only the. Line I This is your estimated tax installment payment.

Lines J K and L If you are paying only the. Line I This is your estimated tax installment payment. Estimated payments may also be made online through Indianas INTIME website.

Your average tax rate is 1198 and your marginal tax rate is. We last updated the Estimated. If you fail to pay your property taxes in Indiana the state may have a tax sale.

Access INTIME at intimedoringov. All counties in Indiana impose their own local. Know when I will receive my tax refund.

Indiana Income Tax Calculator 2021. Percent of income to taxes 31. That means no matter how much you make youre taxed at the same rate.

To make an individual estimated tax payment electronically without logging in to INTIME. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

Lines J K and L If you are paying only the. A lien is a legal claim against your property that is intended to keep you from owing money. Total Estimated Tax Burden 23164.

Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes. Created with Highcharts 607. Find Indiana tax forms.

If the amount on line I also includes estimated county tax enter the portion on. When paying your Indiana income taxes things can get.

Indiana Dept Of Revenue Inrevenue Twitter

Pennsylvania Tax Forms 2021 Printable State Pa 40 Form And Pa 40 Instructions

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Property Taxes By County Interactive Map Tax Foundation

Dor Owe State Taxes Here Are Your Payment Options

Indiana Dept Of Revenue Inrevenue Twitter

Follow The Money Indiana Income Tax Returns

Pennsylvania Pa Tax Forms H R Block

Indiana Sales Tax Small Business Guide Truic

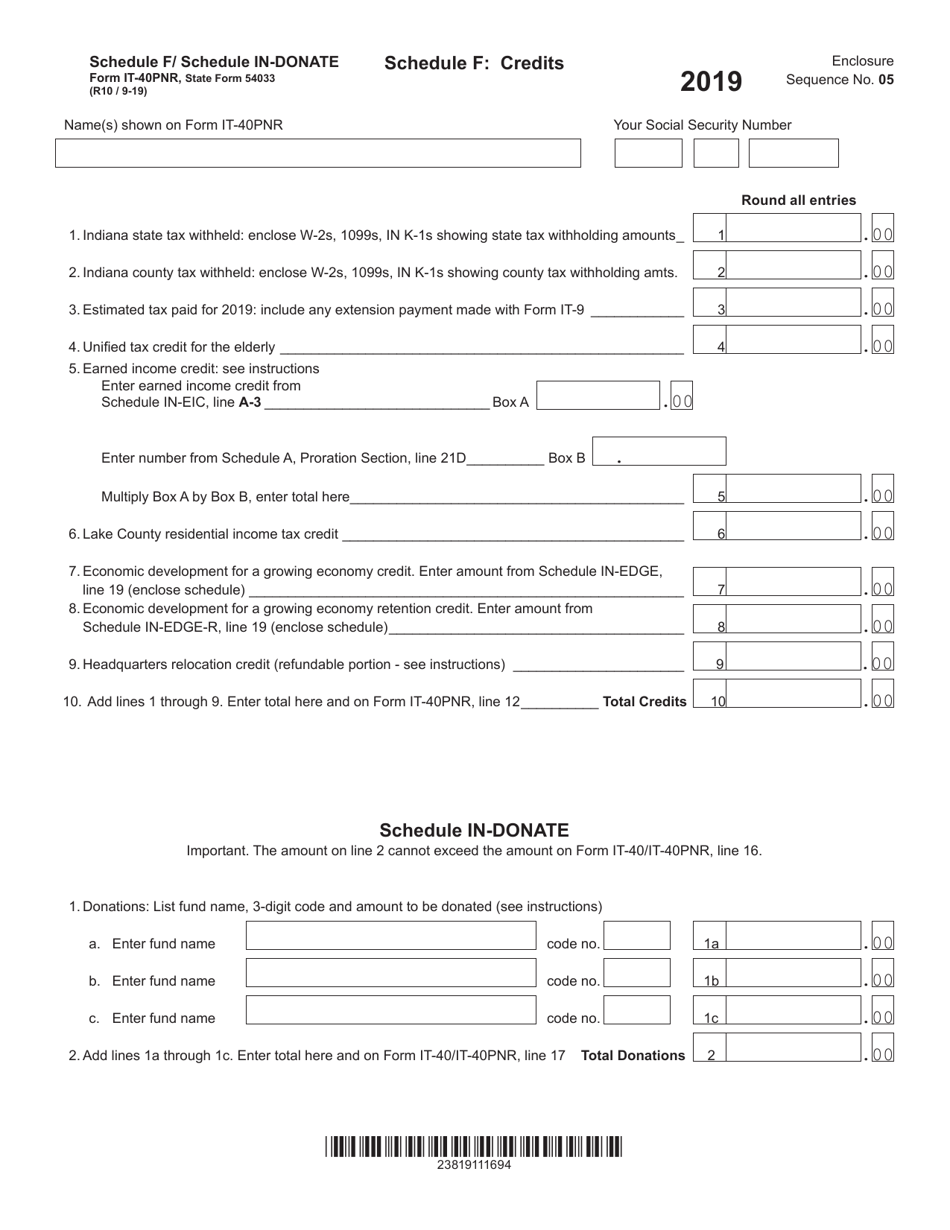

Form It 40pnr State Form 54033 Schedule F In Donate Download Fillable Pdf Or Fill Online Credits Donations 2019 Indiana Templateroller

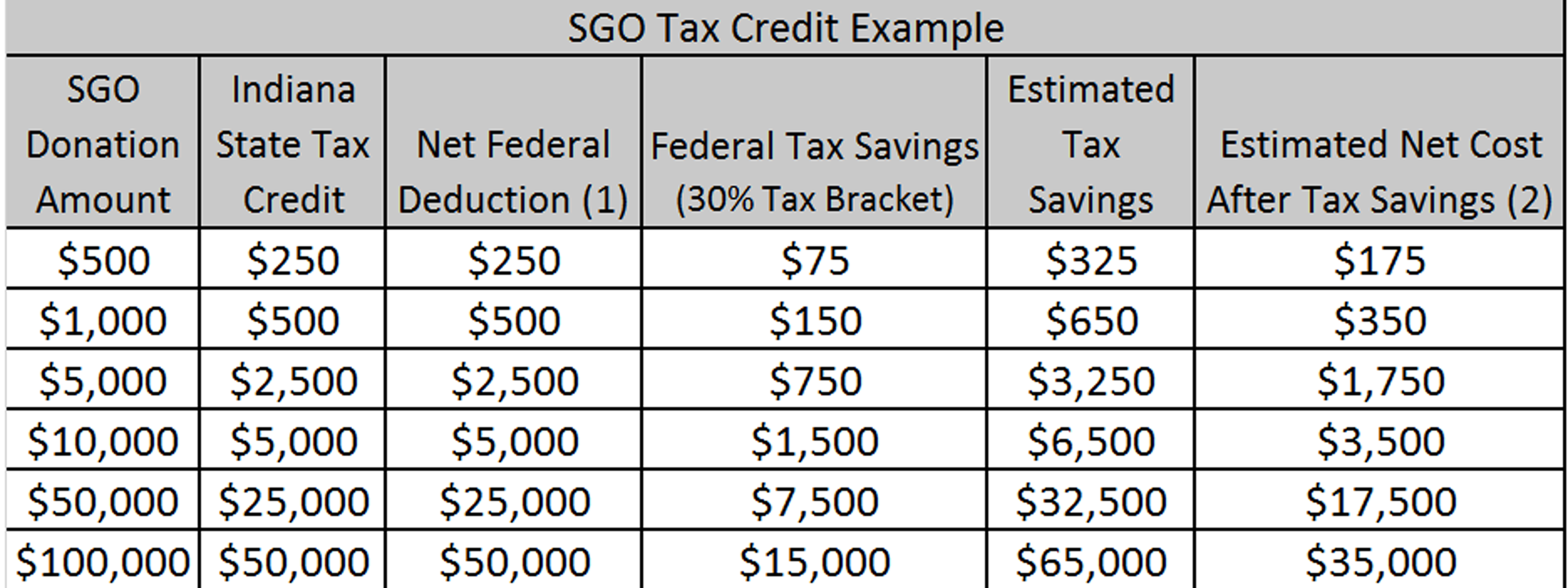

Scholarship Granting Organization Sgo Miscellaneous Marian High School

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Unemployment Compensation State Taxes

Indiana Dept Of Revenue Inrevenue Twitter

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

Estimated Cost Of Attendance Cost Of Iu Paying For College Student Central Indiana University Bloomington

Indiana Dept Of Revenue Inrevenue Twitter

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Tax Refund Here S When You Can Expect To Receive Yours